hawaii capital gains tax worksheet

Capital Gains and Losses Use this section to enter information concerning capital gains and losses on the Hawaii Capital Gains and Loss Worksheet and the Hawaii Capital Gain. Allocation of capital gains and losses.

2021 2022 Long Term Capital Gains Tax Rates Bankrate

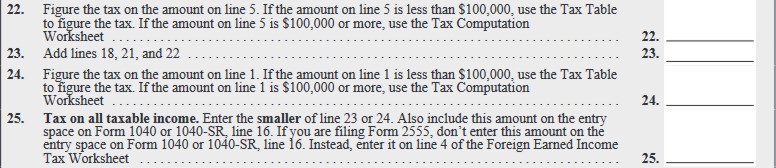

The Capital Gains Tax Worksheet should be used to figure the tax if.

. 83 rows Capital Gains and Losses and Built-in Gains Form N-35 Rev. Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form. Worksheet capital gains tax 1040 qualified dividends form losses.

Income from nonunitary business activities conducted within Hawaii royalties and. Income tax rate schedules vary from 14 to 825 based on taxable income and filing status. Hawaii Capital Gains Tax Worksheet.

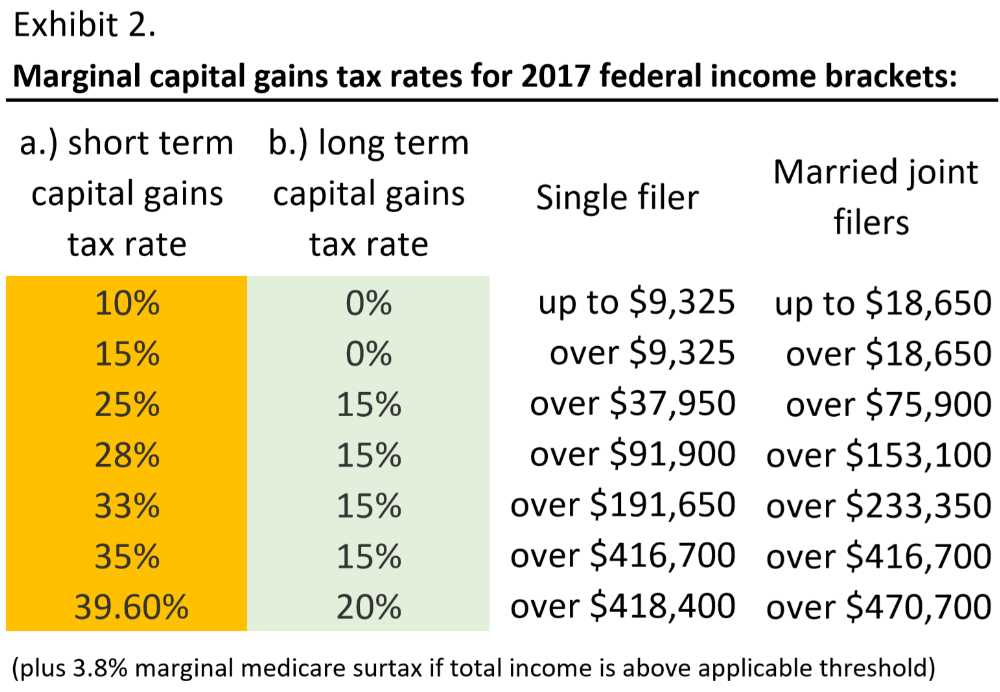

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. You will pay either 0 15 or 20 in tax. Capital Gains Tax Worksheet is used to figure the tax.

Capital Gains Tax Worksheet is used to figure the tax. Hawaii Other Taxes. Tax Computation Using Maximum Capital Gains Rate.

Line 17 Figure taxable income by completing lines 1 through 10 and 1 through 12 of Schedule J of Form N-30. Worksheet capital gains tax 1040 qualified dividends form losses hawaii irs summary. Section 235-7a13 HRS long-term gain.

Hawaii Capital Gains Tax. We last updated the Capital Gains Losses Form N-40 in February 2022 so this is the latest version of Form N-40 Sch. Able to Hawaii and list separately any capital gain or loss and ordinary gain or loss.

These capital gains bracket thresholds increase to 80800 and 501600 for married couples filing jointly. 16f g Hawaii Other Taxes. Capital gains result when an individual sells an.

You pay no cgt on the first 12300 that you make. The Capital Gains Tax Worksheet should be used to figure the tax if. The parents filing status is AND the amount on Form N-615 line 8.

The parents filing status is AND the amount on Form N-615 line 8. You can download or print current. 2016REV 2016 To be filed with Form N-35 Name Federal Employer.

Hawaii Capital Gains Tax Table. Box 3559 Honolulu Hawaii 96811-3559 PRSRT STD US. The amount of net capital gain as shown on Schedule O page 2 line 31b is taxed at the rate of 4.

Long term capital gains are taxed at a maximum of 725. STATE OF HAWAIIDEPARTMENT OF TAXATION SCHEDULE D FORM N-35 Capital Gains and Losses and Built-in Gains. To calculate capital gains tax you.

259 Honolulu HI 96809-0259 or email them to TaxDirectorsOffi cehawaiigov. There are some investments such as collectibles that are taxed. Electronic Filing and Paying Advances Are Being Made Each year thousands of individuals fi le and pay.

D fully updated for tax year 2021. Tax on long-term gain. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Capital Gains Tax Worksheet Irs.

2021 Qualified Dividends And Capital Gains Worksheet Fill Online Printable Fillable Blank Pdffiller

Child Support Obligation Worksheet Split Custody Pdf Fpdf Doc Docx Utah

What S New For 2018 Hawaii Real Estate

State Withholding Form H R Block

Here S How Stock Trading Profits Are Taxed Money

How Your Tax Is Calculated Qualified Dividends And Capital Gains Worksheet Marotta On Money

Is Social Security Taxable 2022 Update Smartasset

How Estimated Taxes Work Safe Harbor Rule And Due Dates 2021

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Mechanics Of The 0 Long Term Capital Gains Rate

Qualified Dividends And Capital Gain Tax Worksheet 2016 Pdf 2016 Form 1040line 44 Qualified Dividends And Capital Gain Tax Worksheetline 44 Keep For Course Hero

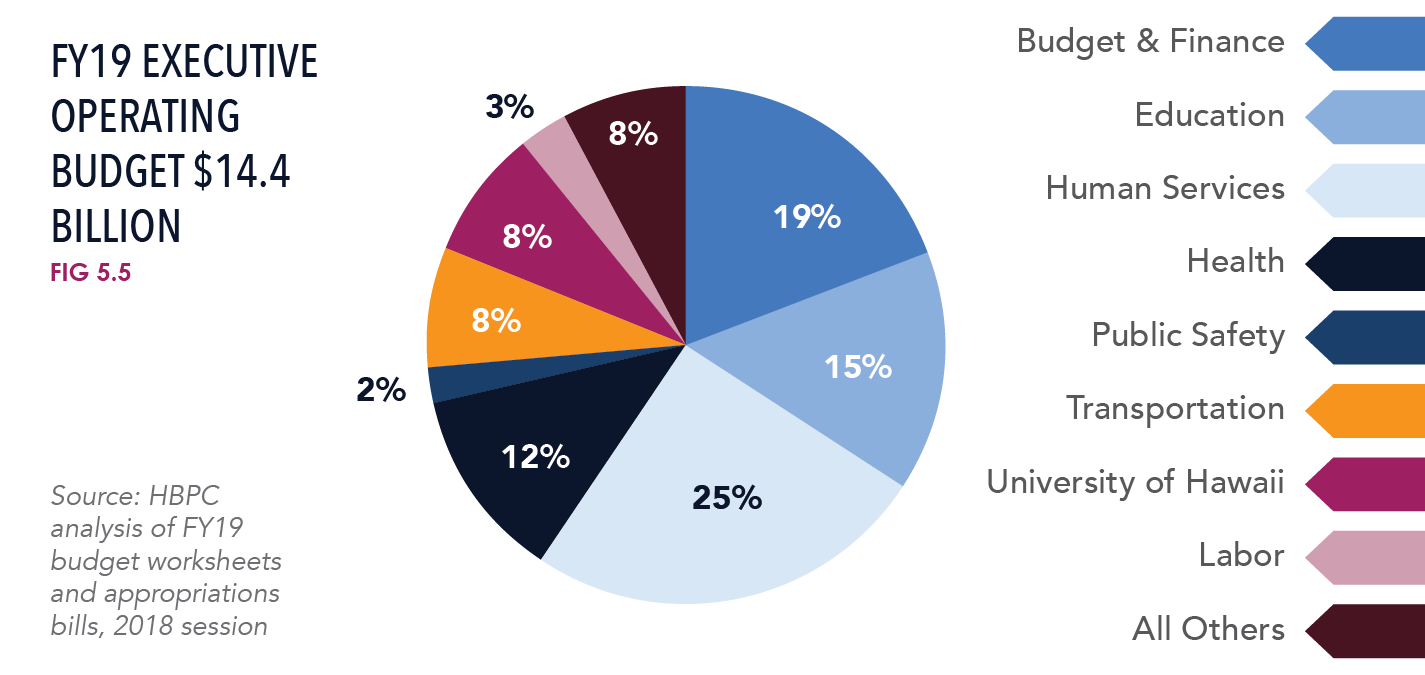

Hawaiʻi Executive Budget In Action 2019 20 Hbpc

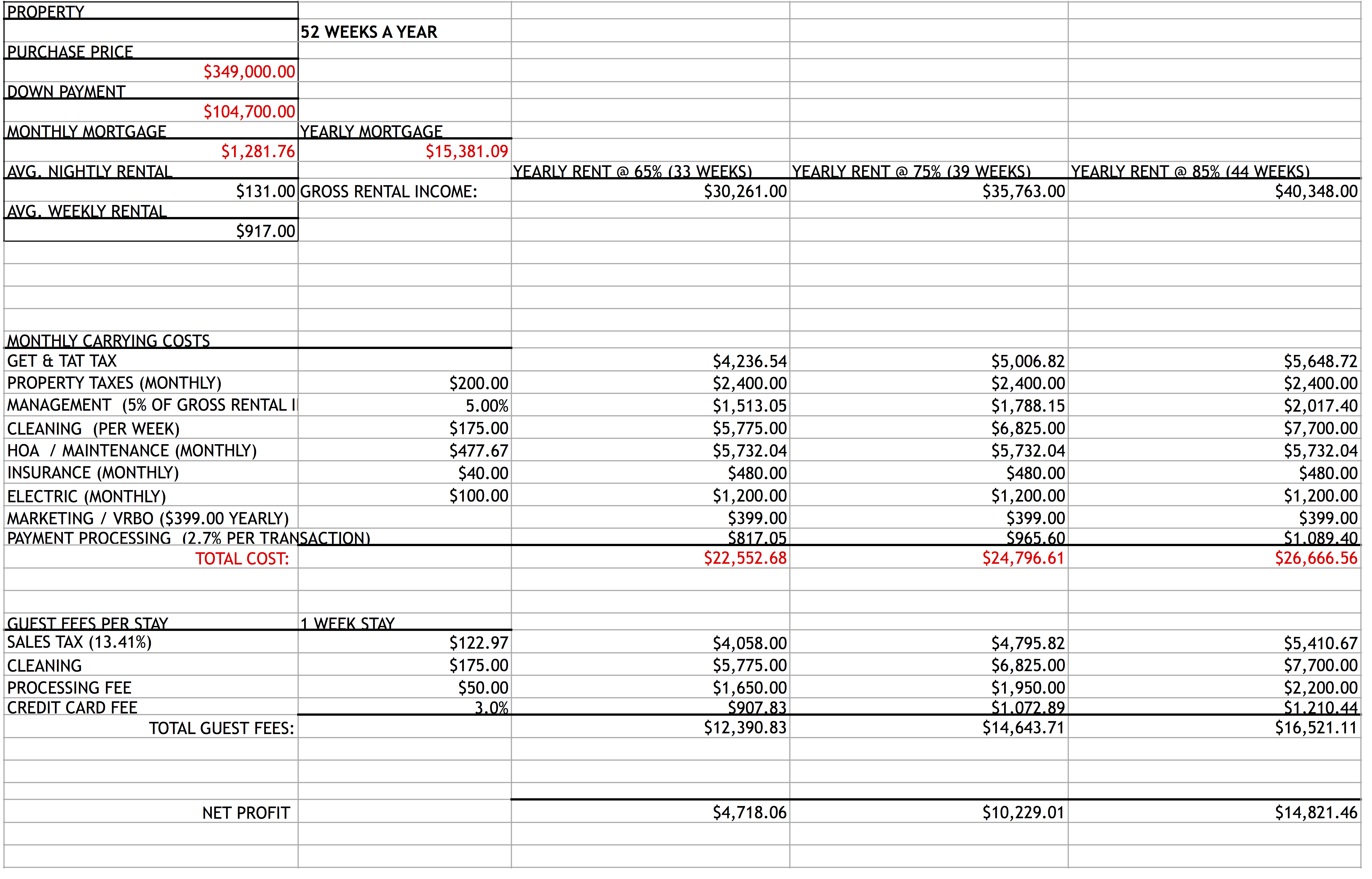

Toolkit For Purchasing Hawaii Vacation Rental Property

Qualified Dividends And Capital Gain Tax Worksheet Chegg Com

Form N 11 Fillable Individual Income Tax Return Resident Filing Federal Return

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller